There are so many matters and complexities related to the accounting system in every organization that they are compelled to use various documents, such as invoices and memoranda. For instance, bookkeeping is an essential part of every business, and it is considered incomplete if invoices, receipts, and memos are not used daily.

What is a credit memo?

A credit memo is a commercially used document that most sellers use for correspondence with buyers. All small and medium-sized businesses like to use credit memoranda. Just as sellers send invoices to their customers, credit memos are also sent to share some critical information with buyers.

When to issue the credit memo?

A seller issues the memo to the buyer right after sending the invoice. The invoice lets the buyer know about the price of a product that he has purchased. It is the price that a buyer is required to pay to the seller. However, when he receives the credit memo, it means that he does not have to pay the price mentioned on the invoice, as the credit memo now shows the new one, and the buyer has to pay that one now.

The concept of the credit memo is quite similar to the refund; however, it does not require the business to refund the money. Rather, the seller adds the reduced amount to the total credit balance of the customer. So, when the customer buys anything next time from the seller, he gets it at a discounted price.

Why is it essential to use the credit memo?

Credit memos are essential to us, and this is why we can find many businesses not using them. However, all those businesses that want to use smart strategies to remain ahead of their competitors like to use them. It also gives an impression to the customers of the business that it takes care of the money of the customers.

A credit memo is best for recordkeeping. If your business works by keeping the record in its database, the memo is going to be the best document for accounting and recordkeeping purposes.

Accountants who are asked to use the memo can monitor the number of sales that were carried out in a specific time period, the number of invoices that have been sent, and much more. The productivity of a company becomes better when useful documents are used with proper care and attention.

What are the elements of the credit memo template?

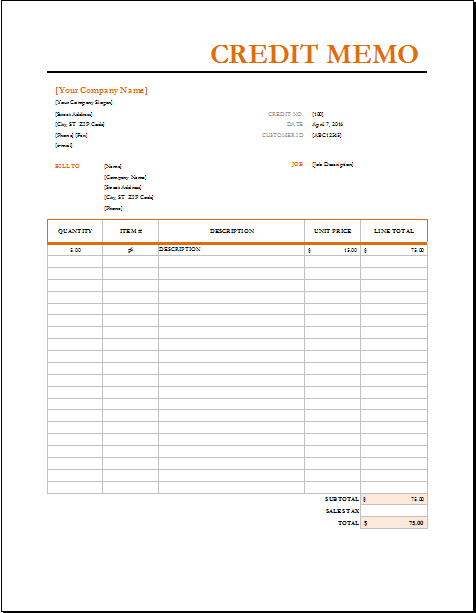

A typical credit memo template includes the following components:

- Customer’s name

A credit memo is always issued in the same of a particular customer and the name of the customer should be mentioned on it.

- Contact and address details of the buyer

The memo template should give some space where the seller can mention the phone number and residential address of the buyer.

- Invoice number:

Every credit memo points to a specific invoice that was issued previously and now the memo is revising the payment to be made by the customer. The unique invoice number should be mentioned in the memo. This way, the customer will be able to understand which invoice the business is referring to. If he has not made the payment yet, he can choose to pay less as per the revision demonstrated by the memo template

- The total amount credited:

Since the purpose of the memo is to let the customer know that the business has credited a specific amount to his balance because of the reduction in the price the customer has already paid, it should mention how much amount is being credited to the account of the customer.

Is using a template useful?

A template provides you easy access to the ready-made credit memo and saves you time as you will not have to create it from scratch. Most of the credit memoranda work in the same way, and therefore, they look almost the same in terms of format, sequence of details, and much more. The template is extremely useful as it is customizable and allows businesses to add more details or remove existing ones depending on their commercial needs.